The availability of cash is a significant factor influencing corporate performance. Without it, managing daily and long-term business becomes tough.

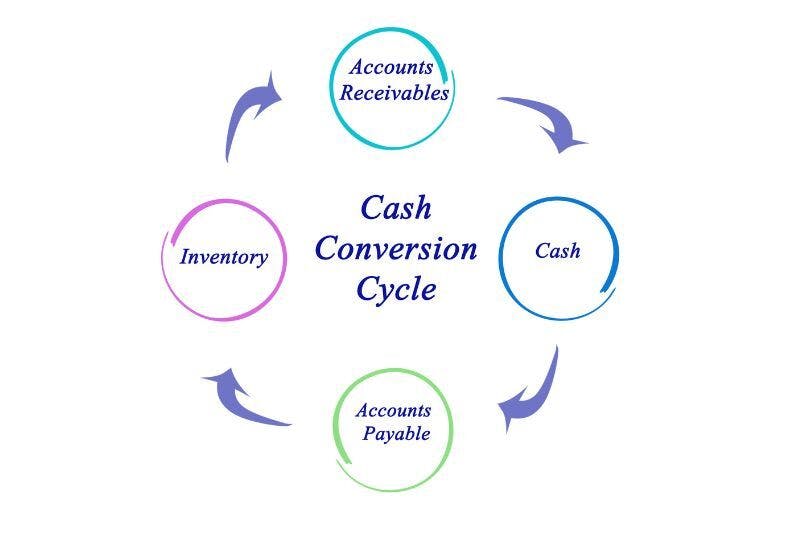

And one of the various measures of cash availability, cash flow, and management effectiveness is the cash conversion cycle.

In this guide, you’ll learn what CCC is and how to improve it to free up more cash to reduce your debt, pay your bills, and invest in your business. Let’s get started.

Courtesy: Canva/ Getty Images

What Is the Cash Conversion Cycle (CCC)?

The cash conversion cycle (CCC), also called the net operating cash cycle or simply the cash cycle, is the time it takes for a company to turn its inventory, investment, and other business resources into profit.

Importance of Cash Conversion Cycle in a Business

The CCC represents a significant metric to measure the company inventory’s operational efficiency. It’s also an important metric to determine that a company has sufficient cash flow.

It is usually used by stakeholders in assessing the company’s financial liquidity and health.

They would see that a lower CCC means that the company can quickly convert its receivables and inventory into cash, improving its ability to pay back business loans and meet financial obligations.

Many vendors also look at the company’s CCC before offering a trade credit. Typically, CCC is lower in companies that function efficiently or have sound cash flow management.

When accounts receivable departments are slow to secure payments, and businesses waste resources, there tends to have higher CCC.

Here’s how you calculate the CCC:

CCC = Days Inventory Outstanding (DIO) + Days Sales Outstanding (DSO) – Days Payable Outstanding (DPO)

To calculate your company’s CCC, you must first determine the period you need the calculation for. Is it for a quarter or a year, perhaps?

Accountants typically recommend about 13 weeks timeframe to calculate because most businesses already have enough cash flow data to make accurate calculations during such a period.

You’ll then need some information from your balance sheets and income statements, including the following:

Accounts receivable at the start and end of the period

Inventory at the start and end of the period

Revenue for the period

Accounts payable at the start and end of the period

Cost of goods sold or COGS for the period

Using the data above, you or your accountant can calculate the individual metrics to determine the cash conversion cycle.

Related Reading: Accounting Method Accrual vs. Cash: Understanding the Differences

Days Inventory Outstanding (DIO)

This is the average number of days the company takes to sell the entire inventory. The smaller the DIO is, which means you held the inventory for less time, the more efficient the company is in converting the working capital into inventory.

Days Sales Outstanding (DSO)

This is the number of days needed to collect payment from accounts receivable. The smaller the DSO is, the better it is for the business. In fact, reducing DSO accelerates cash flow into the company.

Businesses that implement immediate payment have zero DSo, while a business that has net 15 or net 30 payment terms will have a positive DSO number.

Days Payable Outstanding (DPO)

This is the average days it takes for a business to pay its bills. Usually, the longer you pay the bills, the shorter your cash conversion cycle is because you hold cash longer after the sale of inventory. The larger the DPO is, the better.

Cash Conversion Cycle Example

FreshFabric is a fabric store business with inventories that includes fabric, dyes, thread, and print designs. On average, FreshFabric purchases enough of these inventories to last for 60 days or the total number of days it takes to sell the entire inventory (DIO).

FreshFabric has a policy of paying its accounts payable to its suppliers within 40 days (DPO). On average, it also has steady customers who pay their invoices in 45 days (DSO). Here’s FreshFabric’s formula for the cash conversion cycle:

CCC = Days Inventory Outstanding (DIO) + Days Sales Outstanding (DSO) – Days Payable Outstanding (DPO)

60 days DIO + 45 DSO - 40 DPO = 65 Days

In this example, FreshFabric has a 65-day cash conversion cycle. It means it needs 65 days of working capital to purchase inventory and convert it to cash.

Courtesy: Canva/ 74images

What Does a Negative Cash Conversion Cycle Mean?

A negative or steady cash conversion cycle suggests that the company has a high inventory turnover rate and sells its inventory prior to paying for Stock Keeping Unit.

SKU is a unique identifier assigned typically by a manufacturer or a retailer to track inventory and is usually associated with a barcode.

On the other hand, a positive cash conversion cycle indicates that the company’s working capital is constrained until the accounts receivable are paid.

As with any improvement initiative in your company, you wouldn’t know where to begin unless you know where you stand currently.

The first step to improving your CCC should always be calculating the average time it takes for your company to recoup your investment.

You may have the opportunity to improve your business’s cash flow if it’s anywhere longer than 30 days.

7 Tips to Improve Cash Conversion Cycle

1. Closely Monitor Working Capital Metrics

To improve your cash conversion cycle, it’s important to closely monitor and adjust your working capital metrics: DIO, DSO, and DPO.

To adjust the DIO, for instance, developing good working relations with your suppliers helps because it helps manage just-in-time (JIT) and eventually reduces inventory shelf life. JIT inventory management is when you receive only the exact amount of inventory you need right when you need it.

For DSO, offering early paying discounts encourages your clients to pay their invoices early. Other good strategies are to shorten the accounts receivable terms, such as from 30 days to 15 days, and to improve the collection process.

These strategies speed up the time it takes to collect payments. However, find a balance in the collection process in such a way that it will not negatively affect your relations with your clients.

For DPO, it’s better for your CCC if you have a longer time to pay for inventory. Still, it’s important to manage this strategy carefully to balance the potential disadvantage of the stress it puts on your supplier relationships against the benefit to your cash flow.

2. Modify Your Accounts Receivable Payments

It may be a viable option for your business to request a deposit or upfront payments. Immediate payments increase your cash flow and improve the cash conversion cycle.

Using an automated accounts receivable system is also an efficient way to improve cash flow because it leverages your return on investment. Lager changes, such as changing banking systems or improving supply chains, may take a long time and cause disruptions.

A/R solution is simple and provides long-term benefits.

Courtesy: Pexels

3. Disburse Your Accounts Payable Slowly

Paying your invoices according to the terms agreed with the suppliers is recommended, but you won’t benefit from paying early. It increases your cash on hand if you disburse your AP later.

So, if you want to increase your cash on hand, you can set up an accounts payable management system with the help of your accounting department.

Such a system will be where all invoices are paid close to the due dates rather than early.

4. Evaluate Vendor Stability

Financially healthy vendors lessen the risk of supply chain disruption, which may affect your top and bottom-line revenues.

Moreover, reliable vendors make it easier to improve production and the supply chain. All these help improve your cash conversion cycle.

For instance, if you can rely on a vendor to deliver on schedule or as promised, it becomes easier to optimize production campaigns and limit the time the inventory sits until it's sold.

Related Reading: Streamline Your Finances: Effective Small Business Accounting Tips

5. Launch a Pre-Order Sale

Offering pre-orders is an effective and easy way to collect cash upfront before paying for the inventory. It likewise helps you better predict demand.

The biggest advantage of a pre-sale is there’s no expectation from the buyers that they will receive the things immediately. This gives you time to accept an unlimited number of orders without fulfilling them right away.

Then, you may utilize the data to forecast the inventory you need without risking over-ordering. In the same way, you can use the funds already received during the pre-order process.

6. Improve Inventory Turnover

A lot of stock-holding companies have a significant working capital investment in inventory that’s only sitting in their warehouse. The faster you convert such an investment back into accessible cash, either by using them in the manufacturing process or selling the items, the better.

Business can improve their cash conversion cycle by turning over inventory faster. Cutting losses on slow-moving inventory items, even if they can be sold at big discounts, will free up valuable cash and eventually improve your CCC.

Other ways to improve your inventory turnover without harming stock availability are prioritizing inventory classification, reordering smarter, and knowing your inventory’s position in its product life cycle.

7. Make It Easier To Pay

Do your clients still need to visit you in person to send a cashier’s check? Do they still use a difficult payment processing system? If so, consider providing them with multiple payment options.

You may likewise make it possible for them to pick a payment date in a certain month that works for them. All these make it easier to sync their receivables and your payment cycles.

Courtesy: Canva/ Getty Images Signature

What Role Do Accountants Play in CCC Improvement?

Accountants provide financial data that your company needs to make crucial decisions. They can help strategize invoice conversion plans and do wonders to increase your overall business’ bottom line.

Oftentimes, companies only look for accounting help when it’s too late. When that time comes, they cram to hire whoever can solve their problem quickly. Avoid that from happening, whether you’re running a small or large business.

With the help of an accountant, you not only file tax returns on time or correct your accounting books, but you’ll also avoid future penalties. All these factors contribute to you shortening your cash conversion cycle.

Related Reading: Tax Attorney vs CPA: Choosing the Right Professional for Your Tax Needs

Concluding Words

There you go. We hope you find these tips on how to improve the cash conversion cycle helpful for your business.

All these tips, when working in sync, will help your business achieve a favorable balance and allow you to improve your cash conversion cycle.

TL;DR: The cash conversion cycle measures how fast a company converts cash on hand into inventory and back into cash. It can even sometimes be a factor the suppliers use in determining whether to extend credit or not.

A good cash conversion cycle is a short one.

Hall Accounting Company is interested in working with small business customers to improve the cash conversion cycle through technology-driven accounting automation.

Our custom accounting solutions include managing your business’ finances, making sound investment decisions, and preparing your taxes. See Our Full List of Services.